Starting and growing a small business is one of the most exciting things you can do. Whether you’re building a company from scratch or scaling an already-operational machine, one question always comes up:

How do I fund this business?

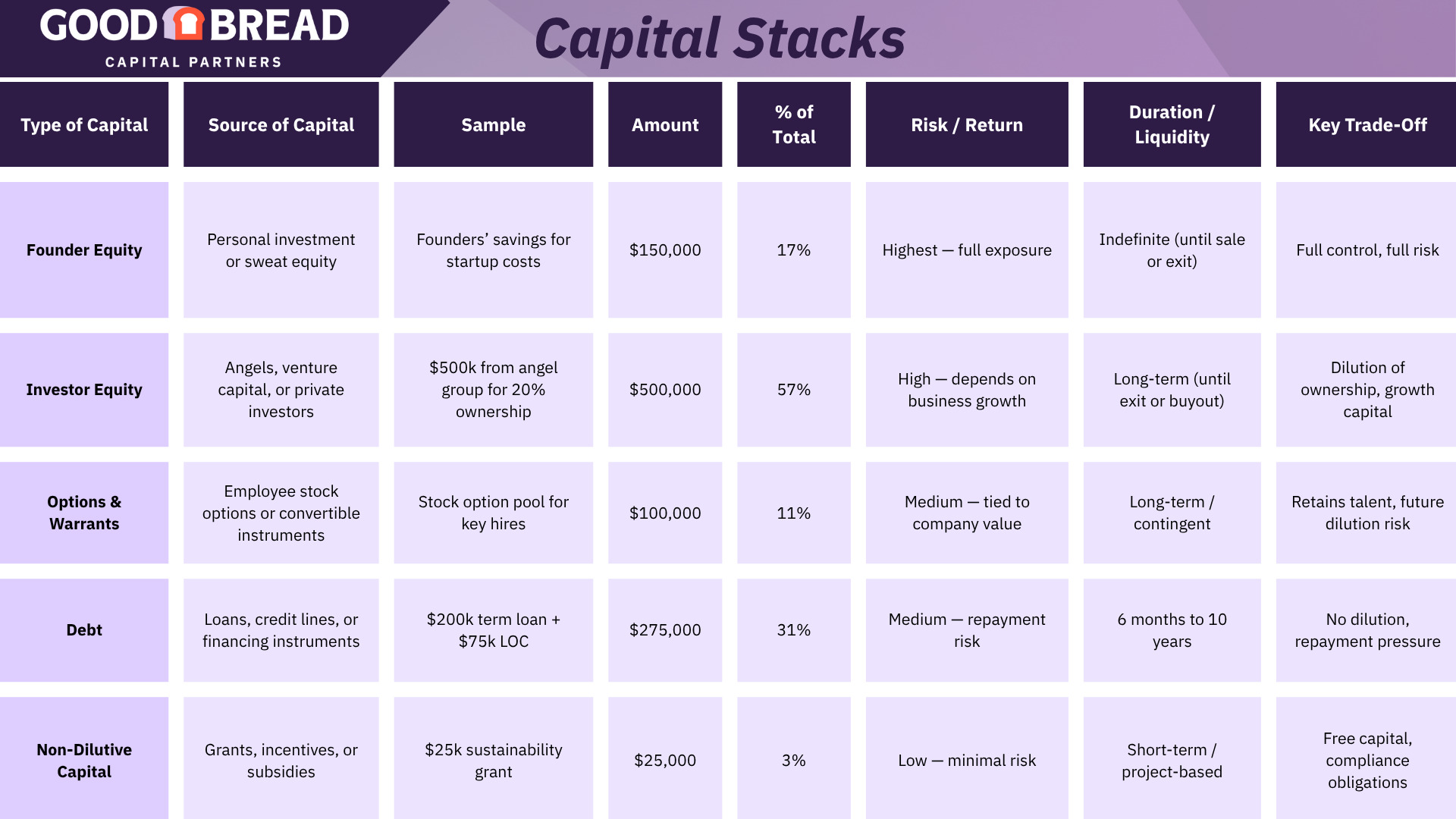

Most businesses that succeed don’t rely on one funding source. Instead, they layer multiple types of financing, each serving a different purpose at a different stage. This mix is known as your capital stack, and it can be the difference between simply running a business and optimizing it for growth and financial returns.

Understanding the Capital Stack

The term “capital stack” comes from the private equity world, but the logic applies to businesses of any size. Picture your funding as a vertical stack of financial tools, each with its own purpose and cost.

At the top, there’s founder equity—your own investment in the business. Just below that is investor equity, which could come from angel investors, venture capital, or public markets. Then you have additional instruments like options and warrants. After equity, which typically carries the highest risk and the highest return, comes debt. There are many debt products to consider: credit cards, term loans, lines of credit, etc. At the bottom of the stack: non-dilutive capital like grants.

Each layer affects different parts of your business. Some impact control, others affect cash flow. Some cost you equity. Others come with strict repayment terms. The goal is to understand products are available to you, and when to use them.

Matching Capital to Your Business Stage

If you’re in the earliest stages—pre-revenue and still proving your idea—traditional lenders likely won’t lend. At this point, equity from friends or angel investors, crowdfunding, or small grants is more realistic. Most people start their small businesses with their own savings and personal credit.

Once you’ve started generating consistent revenue, more tools become available. Business credit cards, working capital loans, and flexible credit lines can help you manage operations and growth. If you have inventory or receivables, asset-based lending may be on the table, too.

More established companies with consistent financials can tap into traditional bank loans. This is also where strategic investors come in—not just with capital, but with expertise and industry connections.

Every stage requires a different type of capital. Startups need flexibility and low risk. Growth-stage businesses need capital that scales with them. Mature companies can focus on long-term cost efficiency, tax treatment, and shareholder returns.

Funding Options in Plain English

Let’s cut through the finance-speak. You’re probably already using some of these tools without even realizing you’ve stepped into the capital stack.

If you’re covering expenses with a business or personal credit card, congrats—you’re already in the game. Just be cautious. Credit cards are helpful when paid off each month, but dangerous when balances carry over.

A business line of credit offers more flexibility. It works like a credit card with higher limits and better rates. You borrow only what you need, and interest is charged only on the drawn amount. It’s ideal for managing uneven cash flow and seasonal gaps.

Then there are short-term and long-term loans. These are perfect for big expenses like equipment, renovations, or hiring. You receive a lump sum, repay it in regular installments, and have predictable terms. But strong financials are usually required to qualify.

If your revenue is steady but not quite high enough for traditional loans, revenue-based financing (RBF) might be a fit. You get upfront capital and repay a percentage of your monthly revenue. If sales drop, your payments drop too. It’s performance-based, and less rigid than fixed loans.

Vendor financing is another underrated strategy. Some suppliers will let you pay later—Net-30, Net-60, or even longer. This gives you time to sell the goods before you owe for them. Many suppliers are more flexible than you think. Just ask.

If you have valuable assets—like equipment, inventory, or receivables—you can explore asset-based loans. Lenders use those assets as collateral to determine how much they’ll lend. It’s a solid option for operating businesses.

Keeping Control: The Power of Non-Dilutive Funding

If your priority is staying in the driver’s seat, non-dilutive capital is your best route. No investors. No cap table drama. Just money, without strings attached to your ownership.

Grants are the gold standard here. You don’t have to repay them, and you don’t give up equity. They’re highly competitive and usually take time to secure, but may be worth the effort.

Crowdfunding gives you access to customer-backed funding before your product even hits the market. Platforms like Kickstarter and Indiegogo let you raise money in exchange for perks—not shares. This form of fundraising usually works best for consumer products.

Bootstrapping is the unglamorous but highly effective path. Reinvest your profits, manage cash wisely, and negotiate better terms with vendors. It’s how plenty of seven-figure businesses got off the ground.

Factoring lets you sell your unpaid invoices for immediate cash. It’s not cheap, but it can help you stay liquid without taking on new debt.

Stacking It All Together

This is where things get interesting. The smartest businesses don’t choose just one funding strategy—they combine multiple sources into a custom capital stack.

They might use equity for long-term growth moves and debt for short-term needs. They rely on grants and bootstrapping in the early stages, then shift to bank financing and revenue-based tools as they scale.

If you have reliable revenue, a term loan or line of credit could be your most cost-effective tool. If your income is seasonal or inconsistent, RBF or vendor financing might give you more breathing room. And if you’re growing fast, blending equity and debt can give you both capital and strategic support.

The best funding choice is the one that fits your goals, risk tolerance, and current cash position.

Where to Go From Here

If you’re staring down a funding decision, unsure what to do next, don’t overcomplicate it. Start by figuring out what you actually qualify for. Then look at what kind of capital aligns with your goals—not just what sounds impressive, and definitely not what worked for someone else.

If you qualify for a grant, apply. It’s time-intensive, but it doesn’t cost you equity or control. If your revenue is stable, consider a loan. If you’re aiming for rapid growth and are open to strategic guidance, equity might be a fit.

You can always blend. Some of the most successful founders use a mix: equity for strategy, loans for logistics, grants for innovation.

You don’t need to have everything figured out. You just need to start moving.

Because your capital stack will evolve as your business evolves. What worked last year may not serve you next year. And what you’re avoiding today might be the best tool in your toolbox tomorrow.

Start now, and you’ll have more control later.

Ready to Take the Next Step?

If you’re looking for a funding partner that actually understands small business, check out GoodBread.

GoodBread offers $5k-$50k term loans for growing small businesses. Whether you’re expanding your inventory, funding a marketing push, expanding locations, or investing in technology, GoodBread makes business financing faster and easier with reasonable terms for our capital.

Start your application now to explore your options and start building a capital stack that works for your growth.