Running a business takes capital, and GoodBread is here to help. We offer loans up to $50,000 with clear terms and repayment plans designed for sustainability.

The cost. With average APRs over 20%, your purchases cost much more over time.

Credit cards are best used to manage short-term expenses, especially when paid in full each statement cycle.

GoodBread loans provide up to $50,000 at competitive rates, with fixed monthly payments you can plan around.

Need more? We work with trusted partners to fund larger loans.

We’re making loans to well-qualified applicants. Ideal applicants have been in business for at least 6 months, have a separate business entity with a business bank account, cash flow to cover loan payments, and have a growth mindset with a clear vision of how to use the loan to grow the business.

Our initial loans are to companies based in New York and New Jersey.

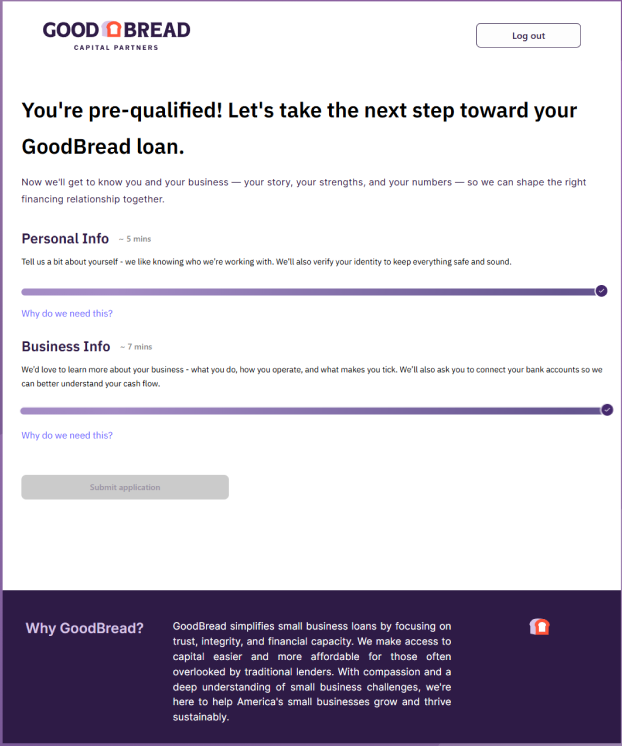

Here’s what to expect during the GoodBread loan application process

Real time transaction data and no more tax returns and financial statements to upload

Tell us a little about your business and how you plan to use the funds, and agree to a soft credit pull so we can look underlying data in your credit history (we don’t use your score in our underwriting process)

Strengthen your application with optional questions, photos, video tours, and connections to community

7 – 10 minutes to complete the loan application (maybe a bit longer if you want to share more)

1 – 3 business days to get a loan decision

Kingston NY

Sweet Deliverance crafts nutrient-rich, botanically infused granola that’s as nourishing as it is delicious. Founded by a chef and wellness advocate, the company brings intention and creativity to the breakfast aisle – and we’re proud to support their growth.

Accord NY

Community Compost Company is redefining waste by turning food scraps into high-quality compost for farms, gardens, and green spaces across the Hudson Valley. They’re building a more sustainable, circular local economy — one bucket at a time.